Endowments and Donor Advised Funds (DAFs)

Thanks to generous legacy gifts from community members, the Manhattan Arts Center (MAC) now has two endowments with the Greater Manhattan Community Foundation.

MAC's First Endowment

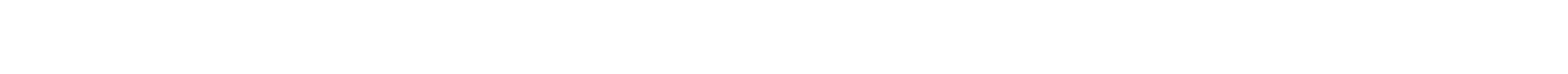

Over the course of several years, Gene and Doris Grosh donated an enormous amount to the Manhattan Arts Center, not just in dollars but also in the form of time and their talents. In the late 1990s, they offered $100,000 as a challenge grant. The board at the time raised all but $10,000 of that amount.

When Gene passed away, it was this $10,000 that Doris wanted to donate, making up the sum to the amount of the donation she and Gene originally intended to make, allowing MAC to establish its first endowment.

Donor Advised Funds (DAFs)

A Donor-Advised Fund (DAF) is a simple, flexible, and tax-efficient way to support your favorite charitable organizations.

Think of it like a charitable savings account: You contribute to your DAF, receive an immediate tax deduction, and then recommend grants to nonprofits like Manhattan Arts Center over time.

How It Works:

-

Make a Contribution

Donate cash, stocks, or other assets to a sponsoring organization (like Fidelity Charitable, Schwab Charitable, or GMCF). -

Receive a Tax Deduction

You’ll get a tax deduction right away for your contribution, even if you recommend grants later. -

Support the Causes You Love

Recommend grants to qualified charities anytime—now or in the future. Your fund can grow tax-free while you decide.

Why Use a DAF?

-

Convenience: Support multiple charities with one account.

-

Flexibility: Choose when and how to make gifts.

-

Privacy: Stay anonymous if you wish.

-

Impact: Grow your giving power over time.

Already Have a DAF?

You can recommend a grant to Manhattan Arts Center using the following information:

Legal Name: Manhattan Arts Center Inc.

EIN: 48-1131531

Mailing Address: 1520 Poyntz Ave., Manhattan, KS 66502

Contact Email: director@manhattanarts.org

We’re honored to be part of your charitable giving journey!

Qualified Charitable Distribution

A qualified charitable distribution (QCD) allows individuals who are 70½ years old or older to donate up to $105,000 total to one or more charities directly from a taxable IRA instead of taking their required minimum distributions. As a result, donors may avoid being pushed into higher income tax brackets and prevent phaseouts of other tax deductions, though there are some other limitations.

Interested in having a conversation about setting up a sustainable Endowment gift for MAC or learning more about Qualified Charitable Distributions? You would leave a legacy that has a lasting impact for the future of the arts in Manhattan. Reach out to Kendra Kuhlman at director@manhattanarts.org today to start the conversation!